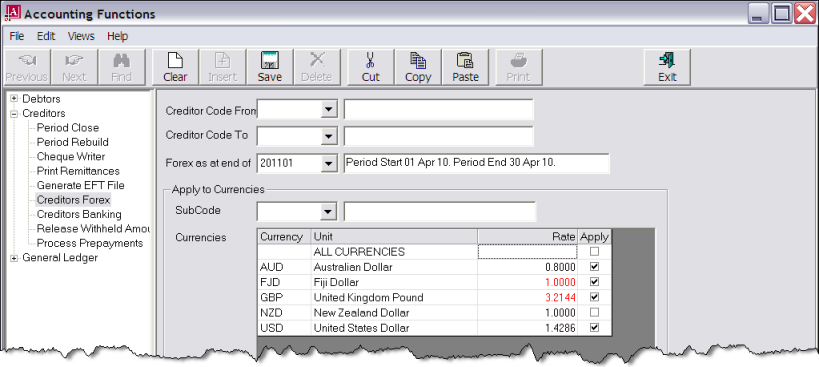

In the following example, the Creditors Forex processing screen is displayed. The Debtors Forex processing screen is identical except it displays Debtor Code From/Debtor Code To.

(continued from Forex Processing Rules)

|

|

In the following example, the Creditors Forex processing screen is displayed. The Debtors Forex processing screen is identical except it displays Debtor Code From/Debtor Code To. |

Screen Shot 34: Foreign Currency Variation Processing Screen

Creditor/Debtor Code From/To (Drop-downs)

These two fields allow processing to be done for all Creditors/ Debtors (leave both of the fields blank); for a specific Creditor/Debtor (select the agent/supplier code in both fields); or a range of Creditors/Debtors (select the first agent/supplier code in the From field and the last agent/supplier code in the To field).

Forex as at End Of (Drop-down)

Only two accounting periods are available for selection in this screen—the current accounting period and the closed period. Selecting the current period will result in the Forex processing being Unrealised; selecting the closed period will make the Forex processing Realised.

Sub code (Drop-down)

The Forex processing can be run for a specific currency sub code if required. To process all sub codes, leave this field blank.

Currencies

|

|

If a currency displays in red, it means that either a) the rate has expired (GBP above) or b) if no rate exists, (FJD above), 1.00000 is used. |

By default, all currencies (except the system base currency–NZD in Screen Shot 34: Foreign Currency Variation Processing Screen) are checked for processing. To process specific currencies, check/uncheck the currency in the Apply column. The currency rates in the rate column are the rates as at the processing date. They can be edited in this screen.

|

|

By default, the system Base Currency is unchecked, as it is not normally required when processing foreign currency variations. However, there are two instances in Debtors Forex processing when it must be included with the selected currencies. Invoice is in base currency/receipt is in foreign currency. Invoice is in base currency/allocated cash is in foreign currency. |

Save

To process the Forex variations, click the Save button in the button bar.

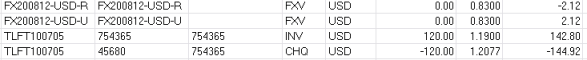

When the process has completed, creditors or debtors affected will have either one or two Forex transactions.

If the period being processed is open then there will be an Unrealised transaction dated the last day of the current period and a Reversal transaction dated the first day of the next period.

Screen Shot 35: Realised Forex Transactions

When the Forex processing is run for the closed period, a Finalised transaction is created. If there was originally an unrealised transaction and reversal (created when that period was current), these will be removed.